At a Glance

In 2022 the EU Commission proposed a significant revamp of the EU Value Added Tax (VAT) rules. The proposals include changes to e-invoicing and digital reporting as well as changes that marketplaces like eBay and its sellers have to follow when it comes to collecting, remitting, and reporting on VAT applied to services and products sold in the EU. Under these new ViDA (VAT in the Digital Age) rules, eBay would become the “deemed supplier” (DS) for the sales of goods taking place through its platform between a seller and a consumer both based in the EU. This means that eBay would collect and remit the VAT payable on those transactions and therefore take over the VAT responsibility instead of the seller.

The DS model already exists in the EU since July 2021 for certain goods sold into the EU by sellers from third countries (imports) as well as goods within the EU sold by non-EU sellers to EU buyers. The development of this model required significant time and effort by a number of teams within eBay, which we believe ultimately benefits sellers who would otherwise struggle to comply with European VAT rules, and we would be pleased to support with expanding this improved experience with a wider range of European Sellers, who often struggle with their VAT compliance as well.

This extension is not without risks: the EU should implement it in a way that would not trigger a systematic price increase especially when it comes to second-hand goods, a large share of which currently benefit from special calculations requiring sellers to account only for VAT on the profit margin (margin schemes).

Recommendations

Issue in Detail

On its previous wave of reform, the EU established a system to tackle VAT evasion for goods sold online from non-European sellers and facilitated through marketplaces: the “Deemed Supplier” (DS) mechanism requires online marketplaces to account for VAT on specific sales to consumers instead of the sellers, when they are not based in the EU.

Today, the Commission is proposing to take the system one step further, by extending the DS mechanism to intra-EU transactions.

We believe this is an important step towards simplifying VAT compliance for European sellers. In fact, the development of the Deemed Supplier model was a multi-year effort for many companies, including eBay, to implement. However, the impact applies only to a certain subset of sellers, meaning that intra-EU trade for many small businesses remains complex. The proposal for VAT in the Digital Age therefore represents an important opportunity to ensure that VAT collection provided through marketplaces can also benefit European small businesses.

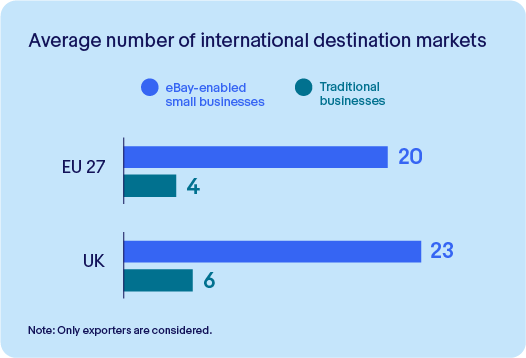

In fact, today, small European entrepreneurs are faced with many challenges to comply with VAT rules in the EU, especially when they take advantage of the Single Market and sell across borders to multiple Member States, which is almost always the case of the average eBay-enabled SME:

Source: eBay Digital Density in Europe, October 2022

The 2021 reform also brought the EU One Stop Shop (OSS), which simplified requirements for VAT registration and declaration for small sellers in the EU. However, it also forced any business passing over a threshold of 10,000 EUR in EU cross-border sales to comply with the principle of destination, meaning to apply the correct VAT rate of each of their buyers’ countries. With hundreds of different rates applicable in the EU, the administrative workload and the risk of error can quickly become significant.

The 10,000 EUR threshold also often conflicts with national VAT exemption thresholds for micro-businesses (e.g. 91,900 EUR total turnover in France in 2022) which leads to micro-sellers having to comply with VAT obligations in other EU countries, but not having the same obligations in their home country.

As a result, we believe the extension of the Deemed Supplier model to be a crucial step towards enabling European SMEs to participate and grow their business within the Single Market.

However, the extension of the DS model to intra-EU transactions cannot take place without proper consideration for specific types of transactions and VAT regimes that exist within the EU. In this context, it is important to attract attention to the issue of special schemes for VAT paid on the profit margin (a.k.a. “margin schemes”).

With changes brought by the ViDA proposal, we expect that sellers employing those special schemes will be faced with the same complexity as currently encountered by more “classic” B2C sellers when selling across borders in the EU. However, their participation in the deemed supplier model is at the moment faced with two caveats:

- First, whether a transaction is or is not eligible to a margin scheme is only known currently by the seller conducting this transaction. Eligibility to use margin schemes depends on a number of factors such as for example whether the original acquisition of the product was made from a consumer, or non-taxable person (C2B). This acquisition is not visible by the platform that would ultimately be the deemed supplier upon resale of this product to a consumer (B2C).

- Second, applying VAT on the profit margin requires having knowledge of this margin, i. e. the initial acquisition price deducted from the final resale price. Because the acquisition is invisible to the platform, it is in turn impossible for the platform to apply VAT as Deemed Supplier on anything other than the full resale price.

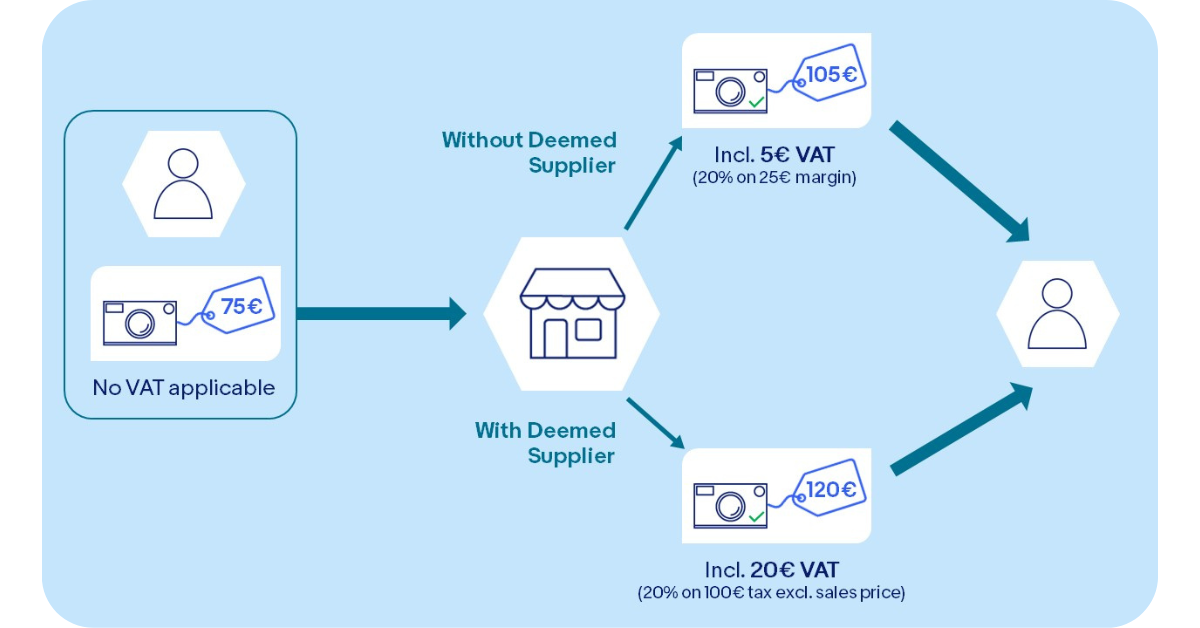

Solutioning these two problems is essential to ensuring proper consideration of the margin schemes within an extended EU Deemed Supplier model. Without it, online platforms would have no other choice but to treat these transactions just like they would any other standard B2C transaction, and apply VAT on the full resale price, thus leading to a systematic increase in the tax-included price charged to consumers for these products.

Illustration of the price increase by the deemed supplier model on products under margin VAT, where the the platform can only apply VAT on the full sales price: A vintage camera is bought for 75€ by a small business from a consumer. The business refurbishes it and resells it for 100€ tax excluded to another consumer. With margin VAT of 20%, the camera can be sold at 105€ tax included. As the platform has no visibility into the seller pricing, and cannot apply the margin scheme, on sales subject to the DS rules, VAT will be charged on the full sales price, so the platform will charge consumers 120€.

Products that benefit from VAT margin schemes tend to be closely linked to the development of the European Circular Economy. Under the ambitious objectives of the EU Green Deal, the share of recommerce transactions in the EU is expected, and even desired, to grow significantly in order to reduce the need for new products that are almost always linked to a higher carbon footprint than their second-hand equivalents. In a 2021 survey, 78% of eBay-enabled European SME sellers said they had already sold non-new items, representing over half (52%) of their total sales. Furthermore, millions of European citizens use eBay to shop more responsibly, and to give a second life to items they no longer need, following our Recommerce philosophy.

Therefore, a Deemed Supplier model that fails to account for margin schemes and triggers a systematic VAT-included price increase for these products is a threat to the European Green Deal.

This threat cannot be avoided simply by excluding these transactions from the DS model, as this would still require the recognition of eligible transactions from non-eligible items. As a result, and to simplify, we suggest that the EU explores excluding second-hand products entirely from the deemed supplier model.